When selecting an online brokerage, several factors should be considered to ensure it aligns with your investment needs and trading style. First, assess the types of investments you plan to make. Some brokerages are better suited for stocks and ETFs, while others may have more robust offerings in options, futures, or cryptocurrency trading.

Consider the fees and commission structure. While many brokerages offer commission-free trading for certain securities, others may charge for specialized trades or have hidden fees. Comparing these costs can significantly affect your bottom line, especially if you trade frequently.

Another aspect to evaluate is the brokerage’s platform and tools. Active traders may require advanced charting tools, real-time data, and efficient order execution. In contrast, long-term investors might prefer educational resources and retirement planning tools.

Customer service and support can be crucial, especially for novice investors who might need more guidance. Check the availability and quality of customer support, including live chat, phone support, and in-person branches if applicable.

Regulatory security and insurance are also vital. Ensure the brokerage is registered with relevant regulatory bodies like the SEC and offers protections such as SIPC insurance to safeguard your investments.

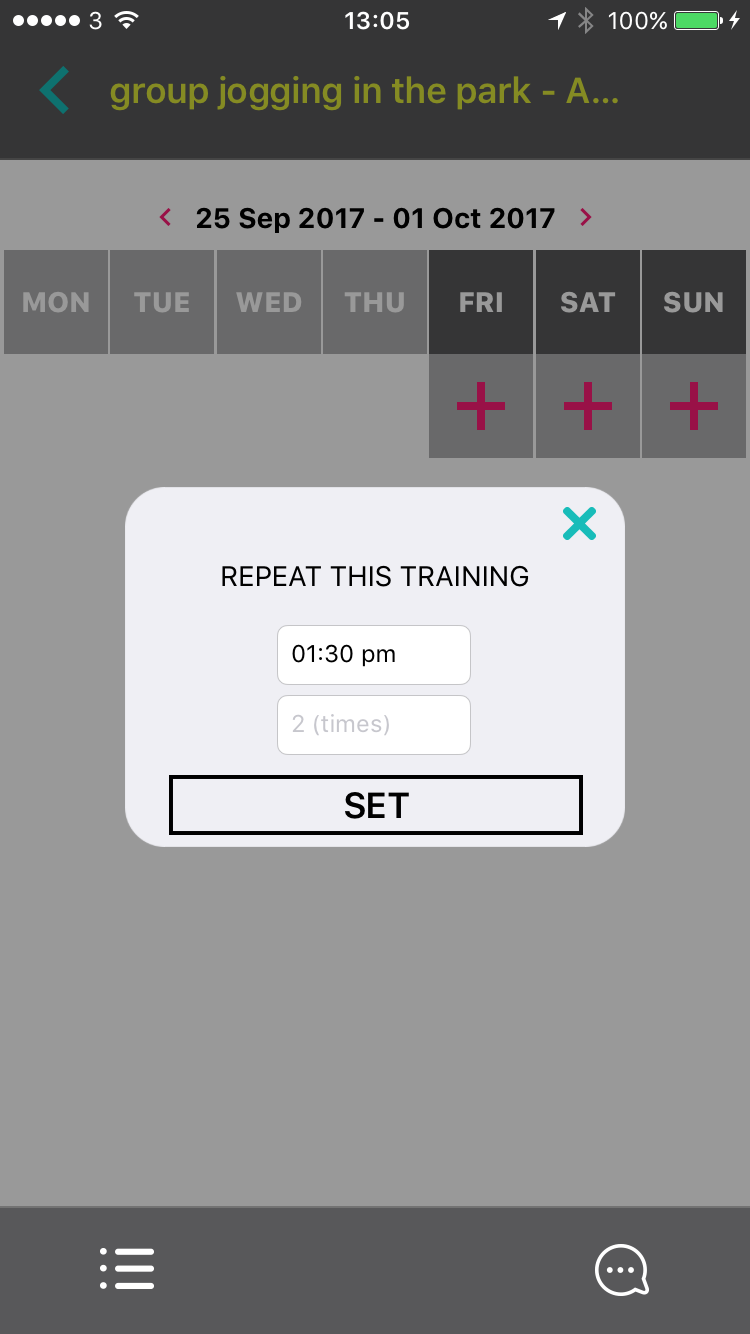

Additionally, consider the ease of use and accessibility of the platform. A user-friendly interface with mobile capability can enhance your trading experience, allowing you to monitor and execute trades comfortably from any location.

Ultimately, the “best” online brokerage is subjective and depends on your individual needs, trading strategy, and preferences. Researching and comparing various brokerages based on these criteria will help you make a well-informed decision.

No responses yet